Key Elements

Whether you are an Ultra HNI, a startup founder, a professional or a corporate treasury, our basic tenets to manage your wealth focuses around:

Investment philosophy

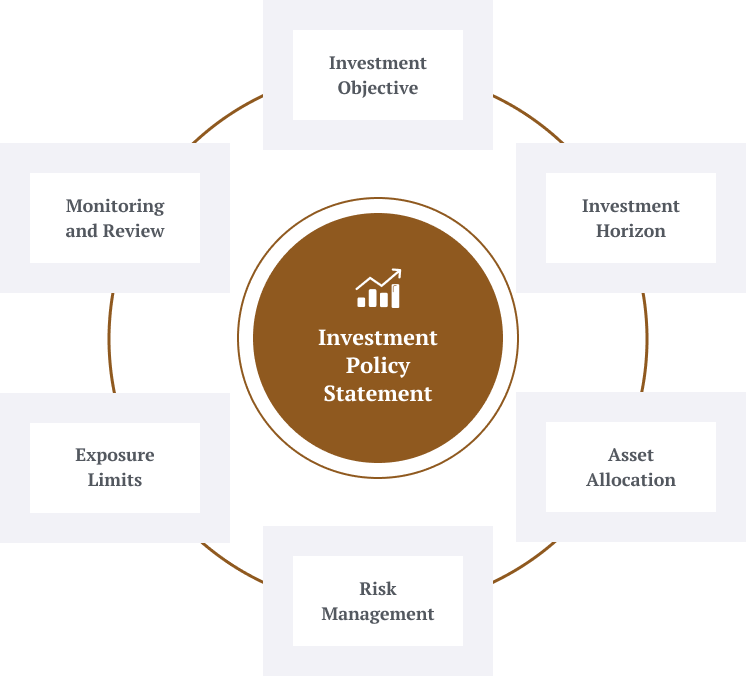

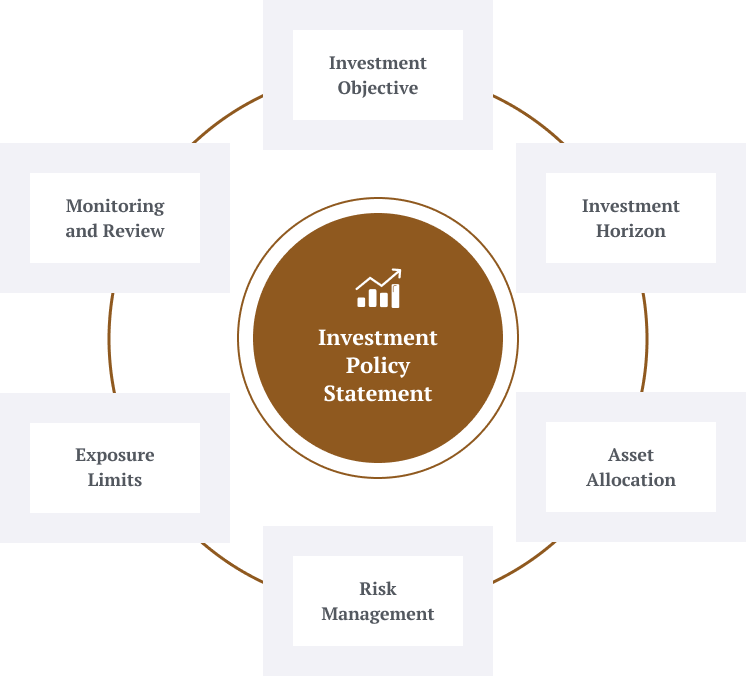

The Investment Policy statement establishes the importance of investment objectives and sets down guidelines for the investments. It puts in place a framework of accountability, bringing a professional and disciplined approach to portfolio management.

Our investment philosophy is true to label ‘Open architecture’, balances in-house and external expertise, matches ‘market context’ to ‘skill sets and capabilities’, treads the fine line between ‘state-of-the-art’ vs. ‘proven and tested’, and looks at ‘portfolio’ over ‘product’ approach.

In addition, the Centrum Investment Guidance Committee (CIGC) is a group of domain experts from the Centrum ecosystem who together bring to the table more than 150 man-years of experience. Asset allocation, product ideation and portfolio construction are guided by the collective wisdom of the group.

GIVLS Model

Shaped by our proprietary Growth, Interest Rates and Inflation, Valuations, Liquidity and Sentiment (GIVLS) model, this framework considers trends of over 50 global and local leading, lagging and coincident economic and market indicators to inform a ground-up opinion.

The factors considered include:

- GlobalUS/Developed markets/Emerging Markets GDP growth/consensus expectations,

Word Bank/IMF outlook, PMI, DXY index. - LocalRBI/CSO growth/consensus expectations, high frequency data, wage trends, bank credit, corporate results, capital formation, current account deficit, capacity utilization.

- GlobalUS CPI/Core CPI, high yield indices, Fed funds futures, US 10 Y yield curve steepness, commodity prices/expectations, US fiscal deficit, G-4 policy stance.

- LocalHeadline/Core CPI – trends/policy/market expectations, WPI, OIS curve, credit spreads, fiscal arithmetic, real rates, INR/REER, liquidity stance.

- GlobalDeveloped market flows, Fund/ETF flows, VIX indices, EPS trends, topical indicators (financial conditions, yield/PE).

- LocalForward PE, earnings momentum, FII/DII flows, India VIX.

Strategic and Tactical

Our asset allocation approach allows for operating within a strategic asset allocation corridor where tactical tweaks can be made, thus allowing portfolios to effectively capitalise on interim opportunities, whilst retaining the envisaged long-term orientation.

In strategic asset allocation, we create different risk and return profiles based on your needs. These could be for example: Wealth Preserver, Wealth Creator and Wealth Maximizer.

Within these profiles, we look at calibrating the exposure to different asset classes based on specific events, instead of taking binary calls such as exiting equities altogether if there’s some crisis or drawdown event.

Tactical asset allocation allows enhancing returns by tilting the portfolio in line with the near–term market context with topical ideas or restricting short term downsides. This includes cash calls, mispriced opportunities & limited shelf-life ideas. Tactical calls help in navigating short term volatility and to capitalize on opportunities.

Rigour in Product Selection

Significantly divergent product performance suggests that product selection is key. It is observed that across time periods, equity fund performance has been very divergent even within clearly defined segments. And the same is true for debt funds too. Barring very commoditized segments (liquid, arbitrage funds), product selection is key across mainstream segments.

Portfolio construction and risk controls

We have defined risk controls and guidance where model portfolios are typically reviewed on an on-going basis (also ahead or post event risks) along with their performance track records vs. respective benchmarks.

One size doesn’t fit all

We have a diverse range of wealth solutions for company founders, CXOs and professionals such as doctors, lawyers and CAs, family offices and corporate treasuries.

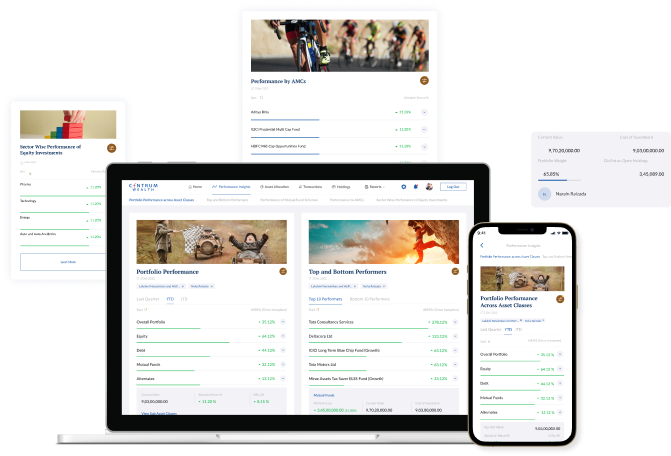

A platform for performance insights

The Centrum Wealth platform, available across Web and mobile, enables you to track and monitor all your investments in one place, and has a host of other features.

Know More

Leadership Perspectives

-

Business

Executive Opinion: Interim Budget 2024

Our Executives share their opinions on India’s Interim Budget, delving into its potential impact on various sectors and offering strategic insights for navigating the fiscal landscape. Their astute opinions unravel the implications, providing a crucial lens for understanding the budget’s impact on the industry and beyond.

Know More -

Business

Today’s Prudent Safety Anchors Tomorrow’s Optimism: Outlook 2024

What does 2024 bring for investors. The India story is strong, valuations are high but with the geopolitical landscape dynamic, what should the investors be mindful of in 2024? Hear Centrum Wealth’s Sandeep Das, Shankarraman R , and Manish Jain discuss the Investment Outlook for 2024. The experts explore the investment landscape while also advising vigilance for blue-skies risks during […]

Know More -

Business

India’s 2024 Outlook & RBI Policy Review

Centrum Wealth’s R Shankar Raman discusses the outlook for India’s growth, interest rates, currency, and the investment approach for 2024.

Know More