Acting from your side of the table

The ‘Your side of the table’ approach which we bring to bear for our Family Office clients, frees the family of investment responsibilities and concerns by becoming an extension of the family. We work closely with your existing network of bankers and investment managers by always keeping the family objectives and the investment policy statement at its core.

Your investments.

Our expertise.

From the inception of our wealth business more than a decade ago, we have consciously stayed away from a ‘cookie cutter’ approach. Based on each family office’s structure, goals and priorities, we offer a range of family office services.

The ‘your side of the table’ approach begins with the holistic investment solutions we bring to our Family Office. These are:

- Commercially aligned to the family office objective

- Having comprehensive investment policy with prudential risk control metrics in place

- Supported by 20 professionals having an overall experience of more than 200 man-years

- Having dedicated operations and services team

- Supported by a robust backend and analytics system

- Having ability to present bespoke investment Ideas basis specific family office requirements

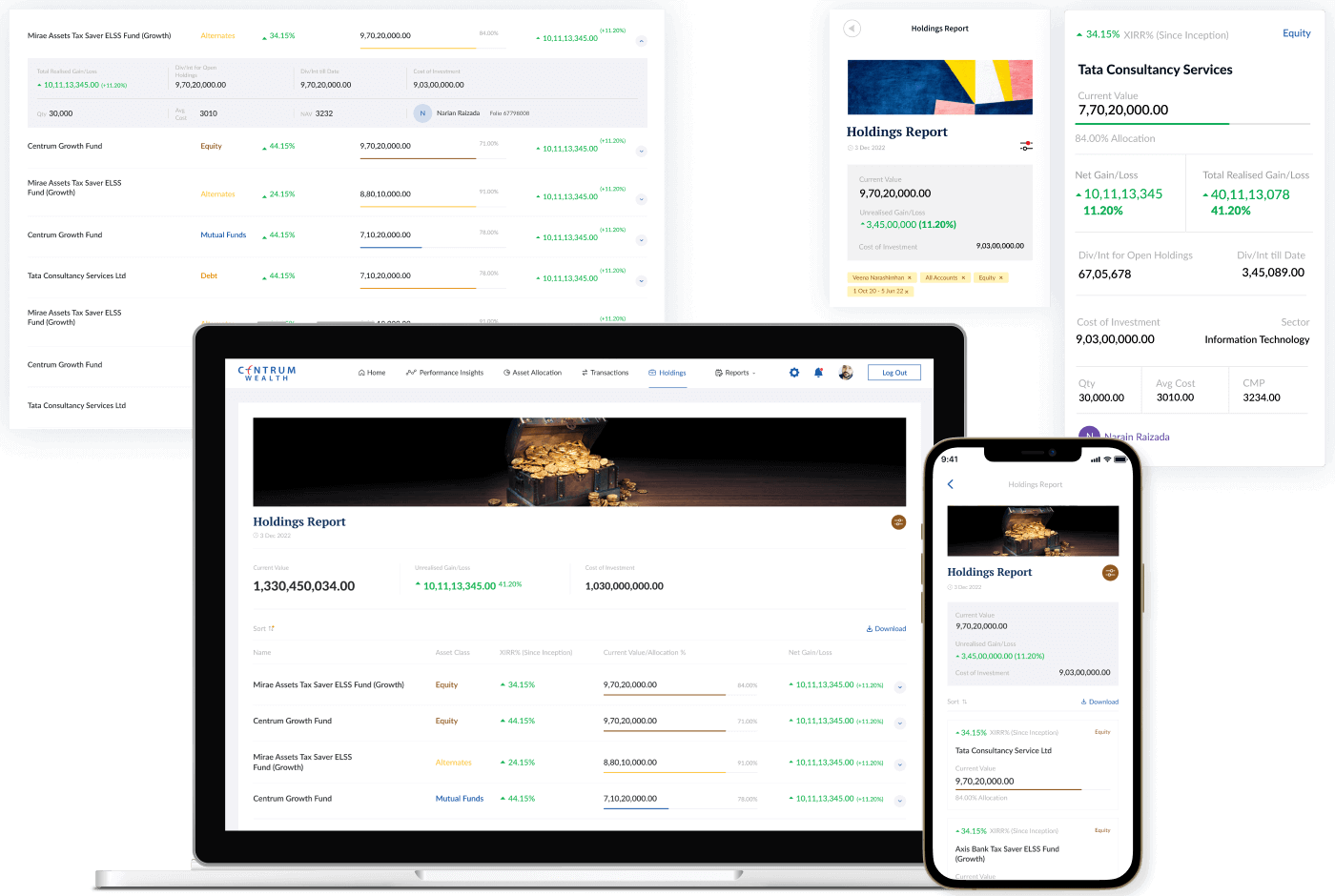

Portfolio consolidation across wealth service providers enables ‘one view’, and is backed by risk and return analytics to ensure advice coming from all around is in-line with family objectives.

This includes:

- Asset distribution view

- A bird’s eye view of family level holdings across service providers

- Comprehensive report on asset distribution across asset classes and products

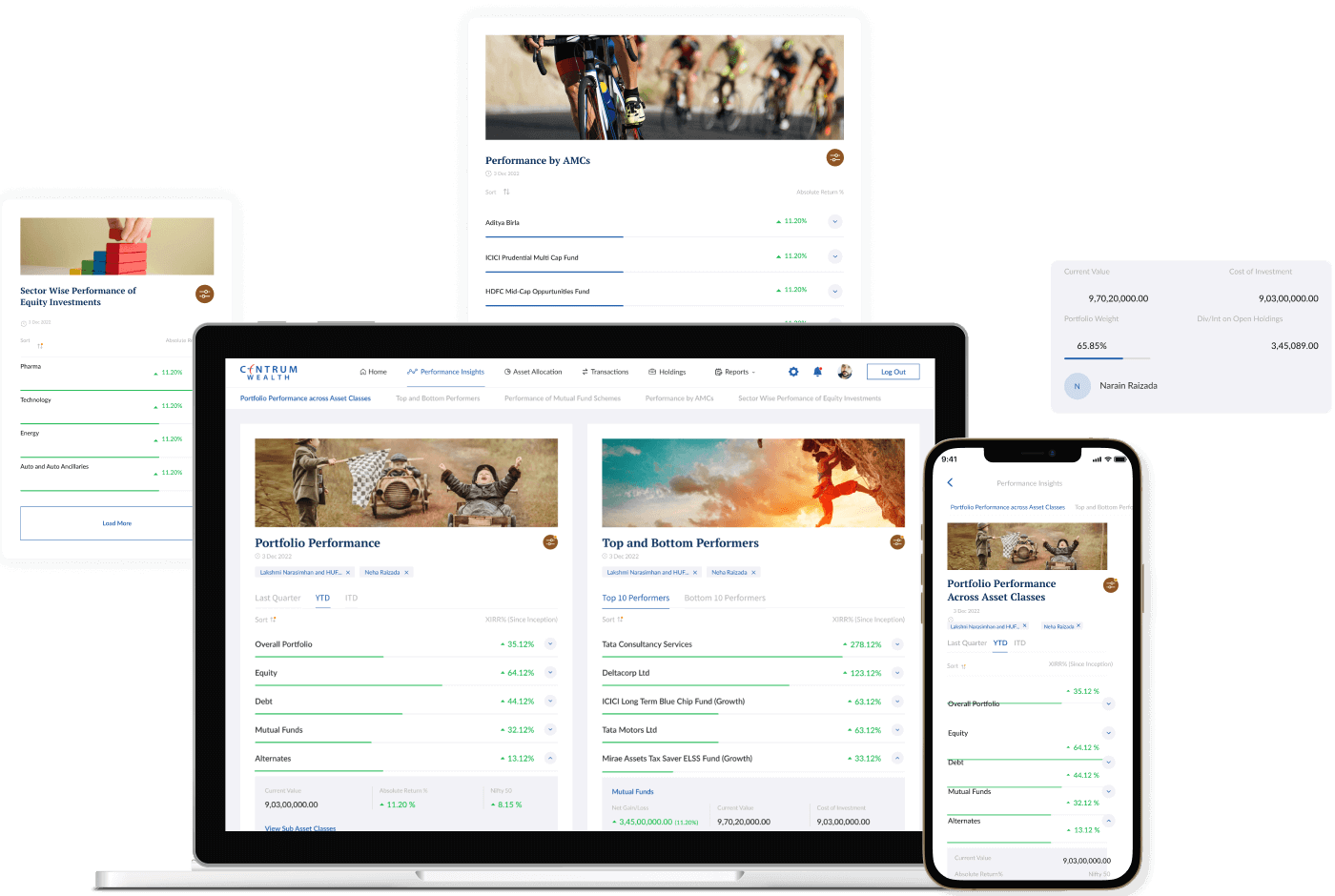

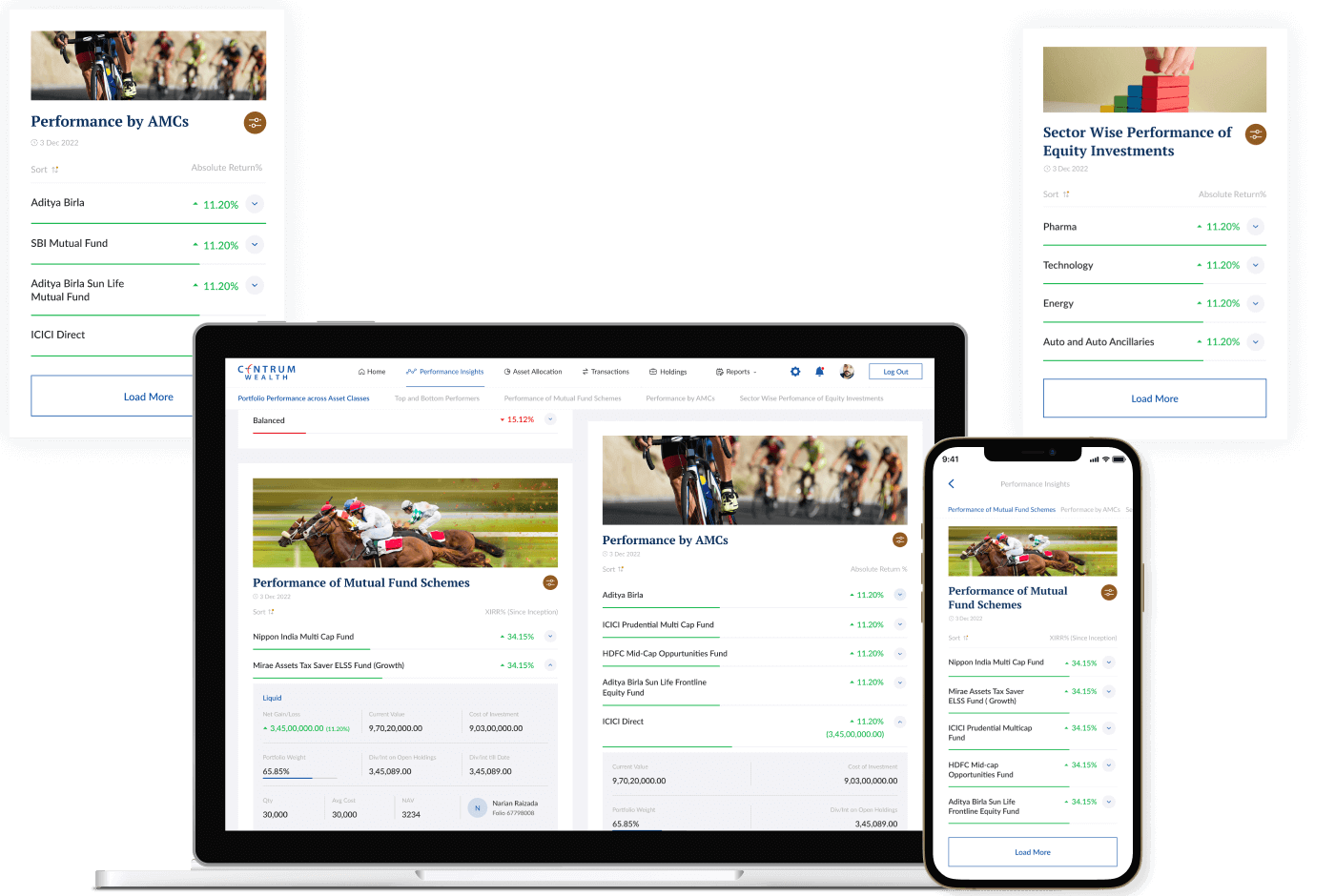

- Performance measurement:

- Detailed performance summary across service providers with benchmarking

- Performance versus benchmark analysis at an asset class and instrument level

- Advanced asset class deep dive:

- Fixed Income analytics including portfolio level credit quality, cash flows, portfolio composition, interest rate sensitivity

- Equity analytics including consolidated underlying sector/ stock holdings/ market capitalisation metrics

With portfolio consolidation, the family office saves time that is usually required while monitoring large portfolios and facilitates smoother decision-making as performance, risk measures and key action points are available at one glance.

If your investment outlook spans the globe and covers developed as well as emerging global markets, we have the services and expertise that can be advantageous.

Through our global office, you get access to an array of offshore investment opportunities. Our team of domain experts perform the required due diligence, product level evaluation and structuring activities.

Specialised wealth structuring services

Wealth structuring seeks to provide appropriate structures that protect, preserve and pass on wealth efficiently. This not only serves the needs of seeking to preserve and distribute wealth as part of legacy planning, but also addresses investment objectives and meets risk preferences.

This specialised service is supported by a dedicated team of tax and legal professionals with a combined work experience of more than 40 years. We also have strong tie-ups and partnerships with Big 4 consultancy firms, marquee law firms, international partners in the UK, US and Singapore, in addition to international immigration experts. Know More

- Gifts

- Wills including offshore structures

- Trusts

- Evaluation on choice of entity

- Solutions for exit strategies

- Structure for overseas jurisdiction (UK/US)

- Advisory on foreign exchange remittances

Family Business Advisory services have become ever more relevant to promoter business families in the recent past, and our focus areas include:

- Business Succession

- Professionalization

- Conflict Resolution

This practice looks at a differentiated approach for the business families and is supported via external consultants and industry experts. As part of this service, we help define and create the family charter and constitution, as may be required.

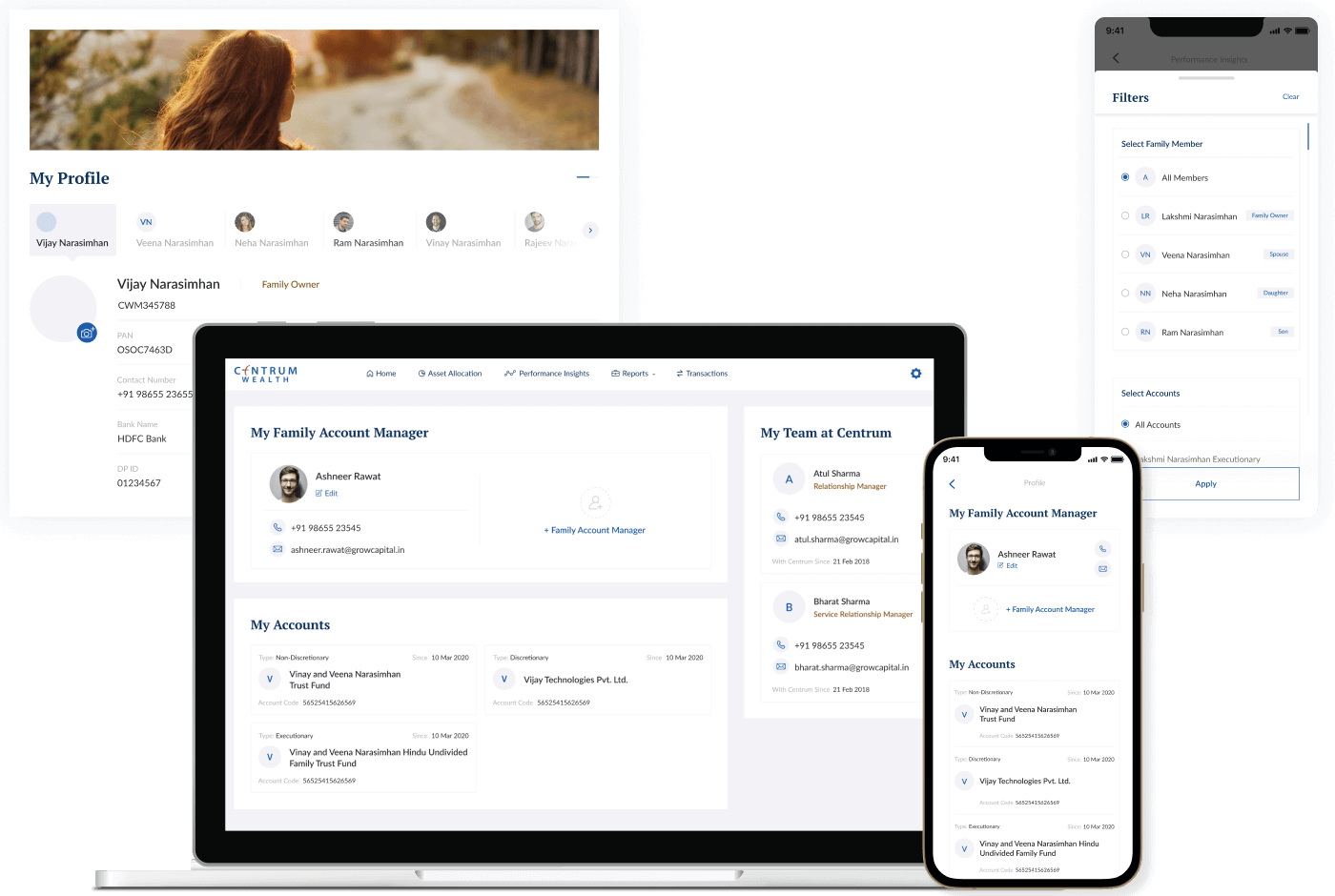

A platform for performance insights

To track all your investments, the Centrum Wealth Wealthverse platform, available across Web and mobile, enables:

Know MoreLeadership Perspectives

-

Business

Executive Opinion: Interim Budget 2024

Our Executives share their opinions on India’s Interim Budget, delving into its potential impact on various sectors and offering strategic insights for navigating the fiscal landscape. Their astute opinions unravel the implications, providing a crucial lens for understanding the budget’s impact on the industry and beyond.

Know More -

Business

Today’s Prudent Safety Anchors Tomorrow’s Optimism: Outlook 2024

What does 2024 bring for investors. The India story is strong, valuations are high but with the geopolitical landscape dynamic, what should the investors be mindful of in 2024? Hear Centrum Wealth’s Sandeep Das, Shankarraman R , and Manish Jain discuss the Investment Outlook for 2024. The experts explore the investment landscape while also advising vigilance for blue-skies risks during […]

Know More -

Business

India’s 2024 Outlook & RBI Policy Review

Centrum Wealth’s R Shankar Raman discusses the outlook for India’s growth, interest rates, currency, and the investment approach for 2024.

Know More