Focus on streamlined returns, optimised cost

We work with corporate treasury teams, across sectors, that are at different stages of growth: right from startups to listed companies to financial institutions.

-

Defining objectives: Analysis of cash flow requirements and working out an investment policy statement. This critical first step establishes investment goals and serves as a guidepost for future investments.

-

Putting the limits in place: Creating necessary guard rails so that risk limits are not busted in ‘good times’.

-

Shortlisting ideas from the investment universe: Identification of appropriate investment vehicles.

-

Streamlined structure: Work with an objective to build a cost-balanced and optimised structure for treasury investments.

Differentiated approach for near term portfolios

We understand that corporate treasury investments may have a relatively shorter investment horizon. The need revolves around delivery of reasonable yields while ensuring adequate liquidity while smoothly navigating the dynamic investment environment.

Our approach aims at matching your

Show More

From Bonds to AIFs and more*

Based on the investment horizon and goals, we focus on a 3-bucket approach for treasuries that focus on fixed income investments. This approach looks at creating a judicious blend of ‘cushions / insulators’ + ‘flexible strategies’ + ‘yield enhancers’ which may be required to navigate volatile markets. This includes:

As an illustration, these could include ideas that avoid near term mark to market impact such as debt oriented or long-short AIFs, market linked debentures and rate reset-ideas.

This bucket may offer tranche entries into medium to long term, Government of India Securities/ State Development Loan roll-down strategies – essentially a prudent mix of high-quality accrual with reducing duration risk instruments.

This bucket refers to those ‘yield boosters’ such as Marked linked debentures, Alternate Investment Funds and other strategies.

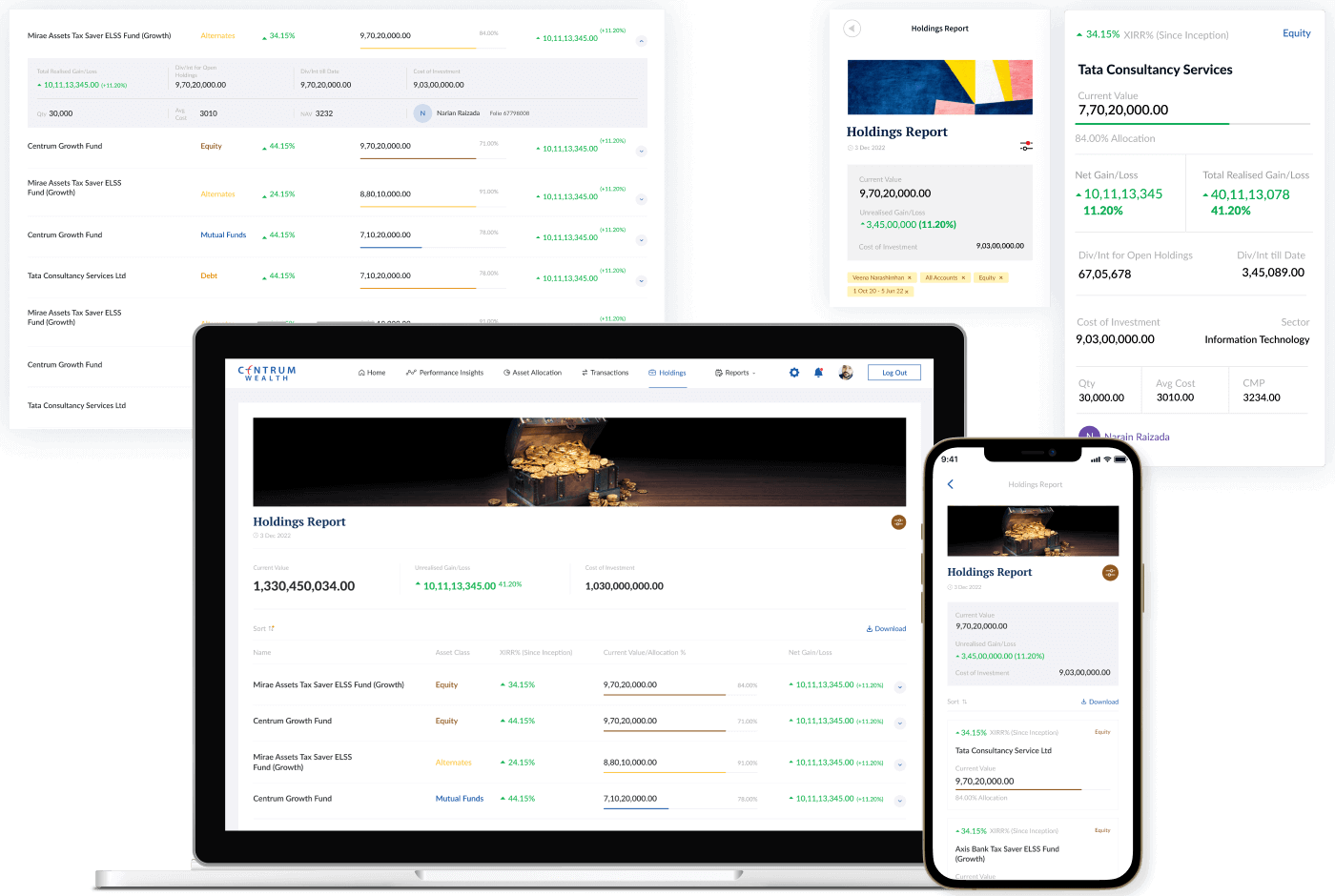

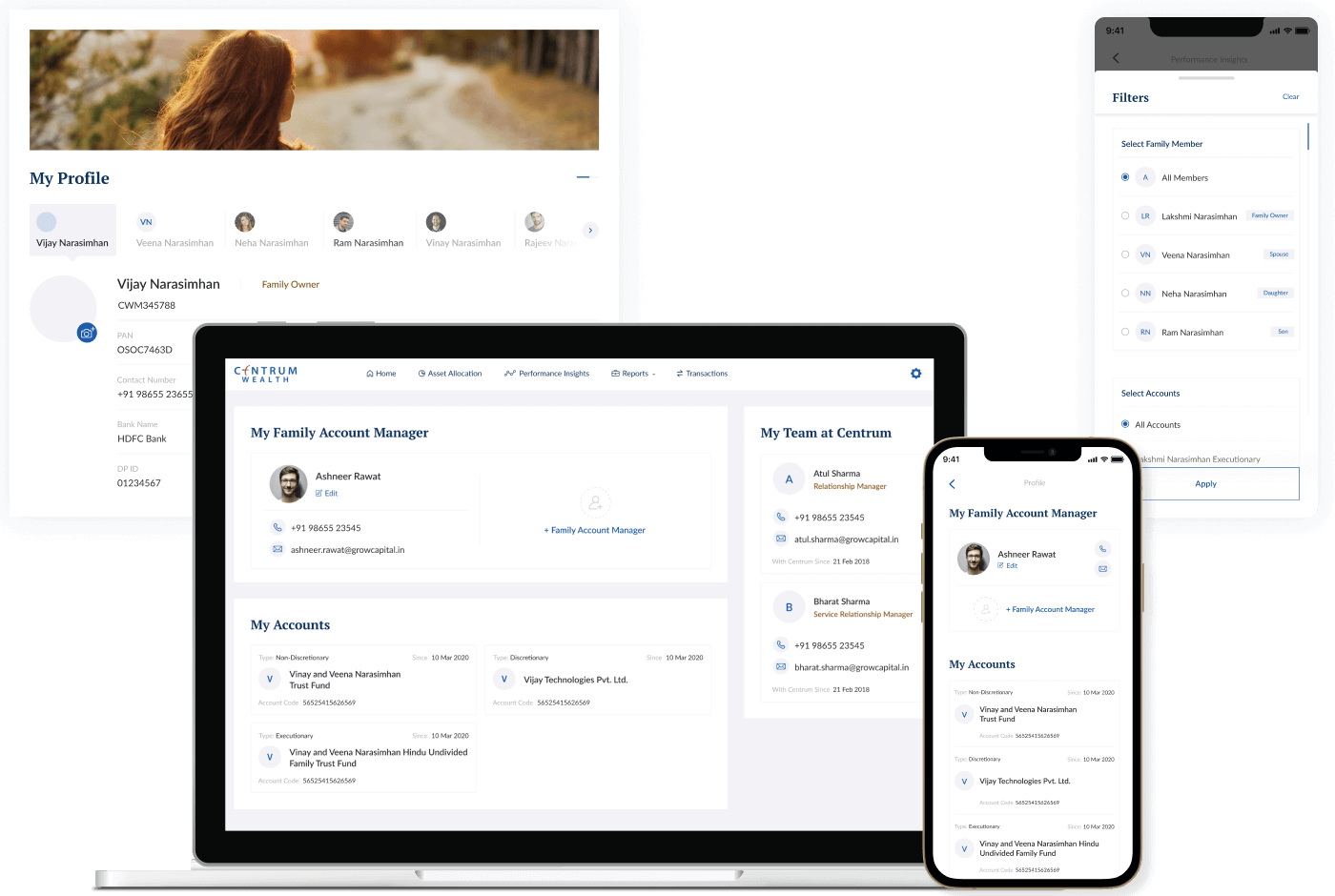

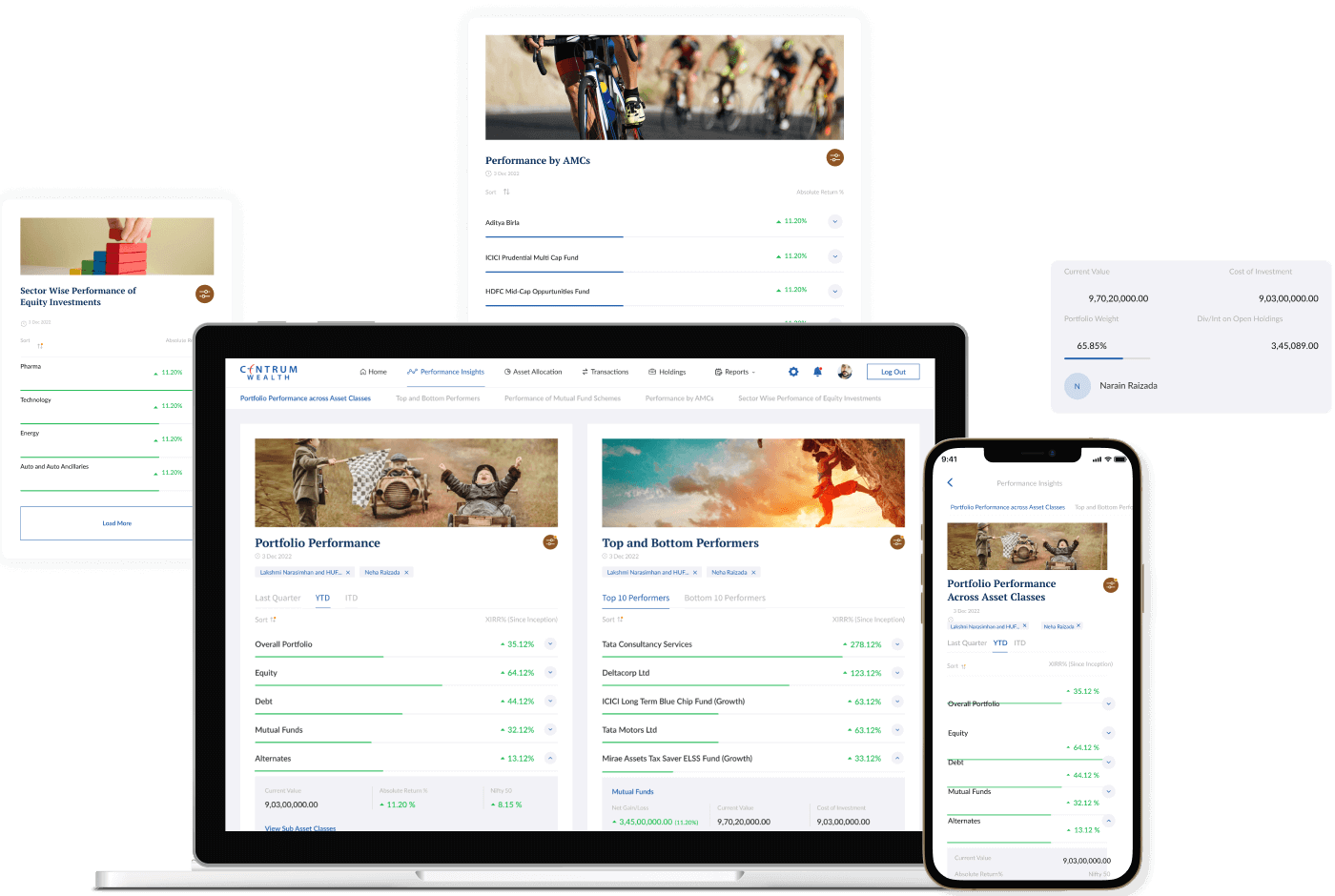

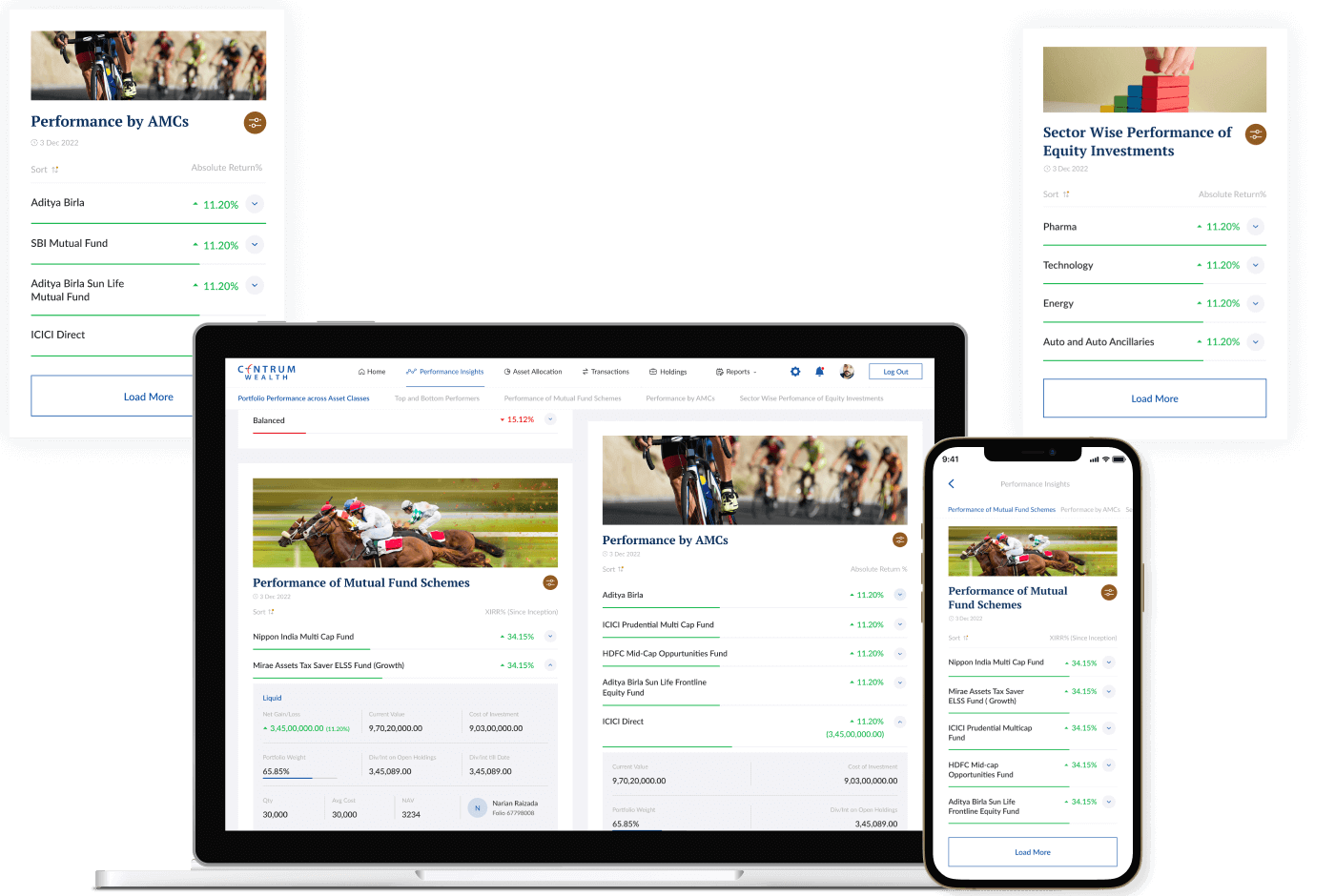

A platform for performance insights

To track all your investments, the Centrum Wealth Wealthverse platform, available across Web and mobile, enables:

Show MoreLeadership Perspectives

-

Business

Executive Opinion: Interim Budget 2024

Our Executives share their opinions on India’s Interim Budget, delving into its potential impact on various sectors and offering strategic insights for navigating the fiscal landscape. Their astute opinions unravel the implications, providing a crucial lens for understanding the budget’s impact on the industry and beyond.

Know More -

Business

Today’s Prudent Safety Anchors Tomorrow’s Optimism: Outlook 2024

What does 2024 bring for investors. The India story is strong, valuations are high but with the geopolitical landscape dynamic, what should the investors be mindful of in 2024? Hear Centrum Wealth’s Sandeep Das, Shankarraman R , and Manish Jain discuss the Investment Outlook for 2024. The experts explore the investment landscape while also advising vigilance for blue-skies risks during […]

Know More -

Business

India’s 2024 Outlook & RBI Policy Review

Centrum Wealth’s R Shankar Raman discusses the outlook for India’s growth, interest rates, currency, and the investment approach for 2024.

Know More